Global Private Debt Report

Global Private Debt Report

To better understand why private debt has performed so well, we have analysed this report from Pitchbook and highlighted some the reports key takeaways.

Why has private debt performed so well?

Fundraising and dry powder in private debt

Private debt fundraising in the traditional institutional channel slowed down in the second half of the year. This was due to increased interest in more liquid alternatives offering similar returns. Around $76.7 billion was raised in private debt funds in H2, down from $112.6 billion in H1 2023. However, the total fundraising for 2023 is expected to surpass $200 billion for the fourth consecutive year. Private debt has now become the second-largest private market strategy in terms of annual fundraising, surpassing venture capital.

Private debt strategies

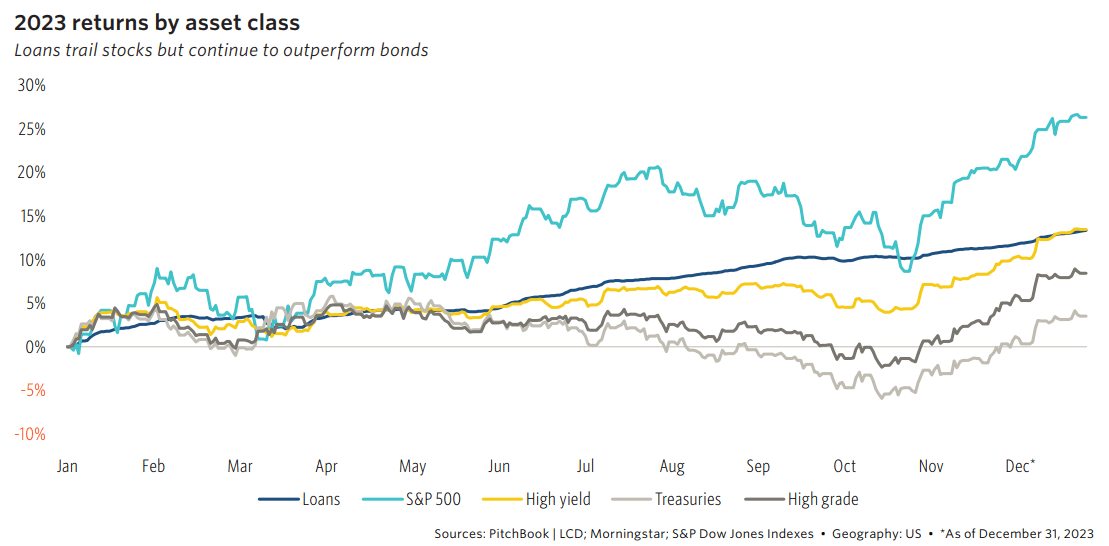

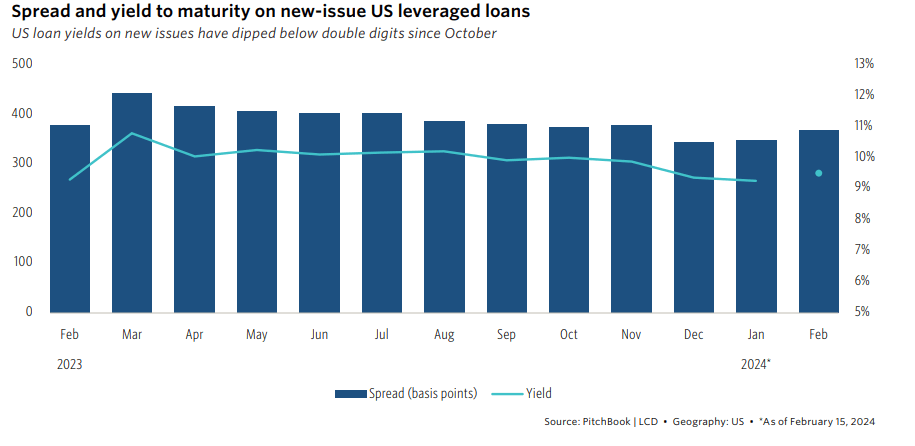

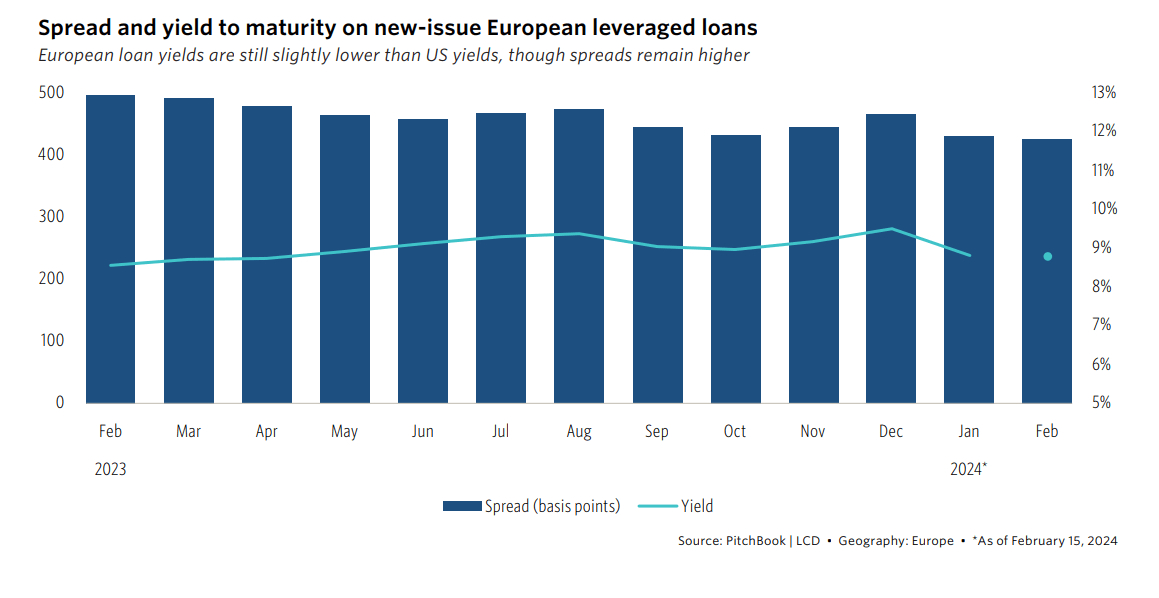

US and European market stats

While interest rates are higher today, investor appetite for private debt remains because in addition to the income generation, these funds provide diversification benefits, high risk-adjusted returns, and a hedge against inflation, among other benefits.’’

Jamal Hagler | Vice President of Research American Invest

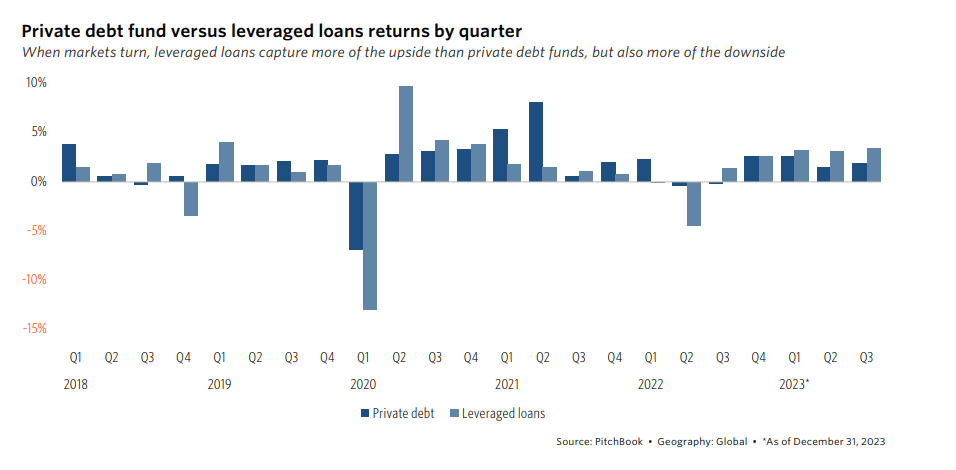

Private debt fund performance

Find your next investor-led CFO or Executive Finance role with Marks Sattin Executive Search

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately-owned businesses across all sectors and locations. With over 30 years of experience, we have helped more than several professionals find their next exciting opportunity.

Apply for an available CFO or Executive Finance job with us today or register your details and we will contact you at the earliest convenience.

Signup to receive the latest discipline specific articles

Related articles

Teaser

Finance & AccountingContent Type

General

25/04/24

Summary

Over the years, we have developed a strong reputation as a leading Senior Finance and Executive Search firm. We’re proud to have well-established teams of finance and accounting recruitment cons

by

Neil Burton

Teaser

GovernanceContent Type

Fintech

18/04/24

Summary

The role of risk and compliance in financial services As a sizeable, growing portion of the financial services sector, risk and compliance play a vital role in ensuring that firms conduct busine

by

David Clamp

Teaser

Executive SearchContent Type

General

18/04/24

Summary

Private equity (PE) is a growing industry that has always attracted ambitious top talent due to its high risk/high gain capital investment. Pre-covid, we saw the global private equity industry b

by

Tracey Alper

Related jobs

Salary:

£95,000 - £100,000 per annum

Location:

City of London, London

Industry

Property and Infrastructure

Qualification

None specified

Market

Commerce & Industry

Salary

£100,000 - £125,000

Job Discipline

Architecture

Contract Type:

Permanent

Description

EA

Reference

BBBH180134

Expiry Date

01/01/01

Author

Michael Moretti

Author

Michael MorettiSalary:

Negotiable

Location:

Dublin South, Dublin

Industry

Manufacturing

Qualification

None specified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Business Analysis

Contract Type:

Permanent

Description

Senior Data Analyst - Dublin South - Global Manufacturing Company

Reference

BBBH179978

Expiry Date

01/01/01

Author

Cillian Mcevoy

Author

Cillian McevoySalary:

Up to €2,600 per month

Location:

Amstelveen, North Holland

Industry

Consumer & Retail

Qualification

Part qualified

Market

Commerce & Industry

Salary

£25,000 - £30,000

Job Discipline

Newly Qualified Finance

Contract Type:

Permanent

Description

Medewerker Data Entry

Reference

BBBH180140

Expiry Date

01/01/01

Author

Elisa Beckschebe

Author

Elisa BeckschebeSalary:

Up to €3,500 per month

Location:

Ouder-Amstel, North Holland

Industry

Professional Services

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£35,000 - £40,000

Job Discipline

Qualified Finance

Contract Type:

Permanent

Description

GL ACCOUNTANT

Reference

BBBH180104

Expiry Date

01/01/01

Author

Elisa Beckschebe

Author

Elisa BeckschebeSalary:

Up to £15 per hour

Location:

Abingdon, Oxfordshire

Industry

Business Services

Qualification

None specified

Market

Commerce & Industry

Salary

£100 - £150

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Working in partnership with an organisation in the Pharma industry to recruit a Collection Assistant. This is a 3-6 month contract paying around £15 (Umbrella)

Reference

BBBH180152

Expiry Date

01/01/01

Author

Ali Arslan

Author

Ali ArslanSalary:

£32,000 - £35,000 per annum

Location:

Birmingham, West Midlands

Industry

Property and Infrastructure

Environmental, Social and Corporate Governance

Qualification

Part qualified

Market

Commerce & Industry

Salary

£35,000 - £40,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Marks Sattin are partnering with a rapidly growing Housing / Property organisation in Birmingham who are seeking an Assistant Management Accountant.

Reference

BBBH180136

Expiry Date

01/01/01

Author

Anthony Mills

Author

Anthony MillsSalary:

+ Benefits

Location:

London

Industry

Private Equity

Qualification

Fully qualified

Market

Financial Services

Salary

£100,000 - £125,000

Job Discipline

Qualified Finance

Contract Type:

Contract

Description

Senior Fund Controller (Private Debt Funds) - 12m Contract

Reference

BBBH177293

Expiry Date

01/01/01

Author

Paul Roche

Author

Paul RocheSalary:

£150,000 - £175,000 per annum + Equity, Bonus and Benefits

Location:

West Midlands

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin executive search is working with a PE-Backed Environmental services business

Reference

TA 3255

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£150,000 - £170,000 per annum + Equity, bonus and benefits

Location:

Essex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a PE-backed multisite product-led distribution business

Reference

TA 3252

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£150,000 - £175,000 per annum + Equity, Bonus and Benefits

Location:

Yorkshire and the Humber

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search has an exciting opportunity for a CFO to join a PE Backed infrastructure business

Reference

TA 3253

Expiry Date

01/01/01

Author

Executive Search

Author

Executive Search