The latest in European private equity 2023

Over the past year, Europe has experienced significant economic upheaval, including the war in Ukraine, excessive inflation, rising energy costs and the cost-of-living crisis. And whilst there were significant fears of a brutal recession hitting Europe at the end of 2022, this has not materialised. In fact, Goldman Sachs is predicting the euro zone economy will grow by 0.6%. Moreover, euro zone inflation is expected to be around 3.25% at the end of 2023, compared with 4.5% initially forecast. All these factors have a profound impact on private equity investment and deal-making.

To understand the impact of these macroeconomic trends, we have reviewed Pitchbook's latest European Private Capital Outlook for 2023.

Some key highlights on Private Equity going into 2023, include:

- Take-private deal value will reach €30 billion

- Fewer than 40 PE-backed public listings will take place

- PE carveout deal value will account for more than 15% of aggregate PE deal value

- 2023 will see a record €60billion of dry powder in the European VC ecosystem

- The venture growth stage will represent over 25% of all deal value in Europe

- European VC deal activity with US participation will represent over 25% of deal count

What does this mean as investors going into 2023?

Pitchbook’s research comes from investors, dealmakers, investment bankers and other sources close to the deals taking place.

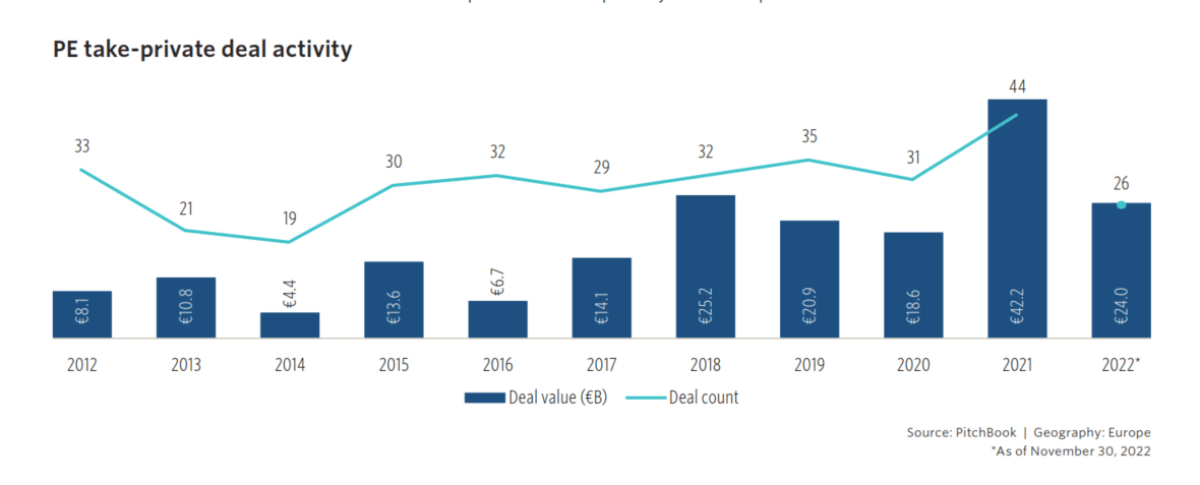

More take-private deals

2022 was a record year for take-private deals and we anticipate this trend to continue. It is no secret that publicly listed companies have struggled the past few years, with share prices struggling. Scrutiny has increased significantly with rising costs and weak growth. From a business perspective, PE firms with elevated levels of dry powder (the amount of committed, but unallocated capital a firm has on hand), could supply a much sought-after injection of capital for publicly listed companies.

From an investor perspective, PE firms will be targeting businesses which are operating significantly below their record trading levels. Pitchbook are anticipating take-privates could account for a considerable proportion of capital deployment in 2023. Moreover, PE firms are in a unique position to identify undervalued firms and put capital to use in the hope of delivering returns when markets stabilise and rebound.

However, Pitchbook has identified take-private leveraged buyouts (LBOs), which are often funded with debt and will become less common. This is due to aggressively rising interest rates. In the current economy businesses simply do not have the risk appetite amid the uncertainty.

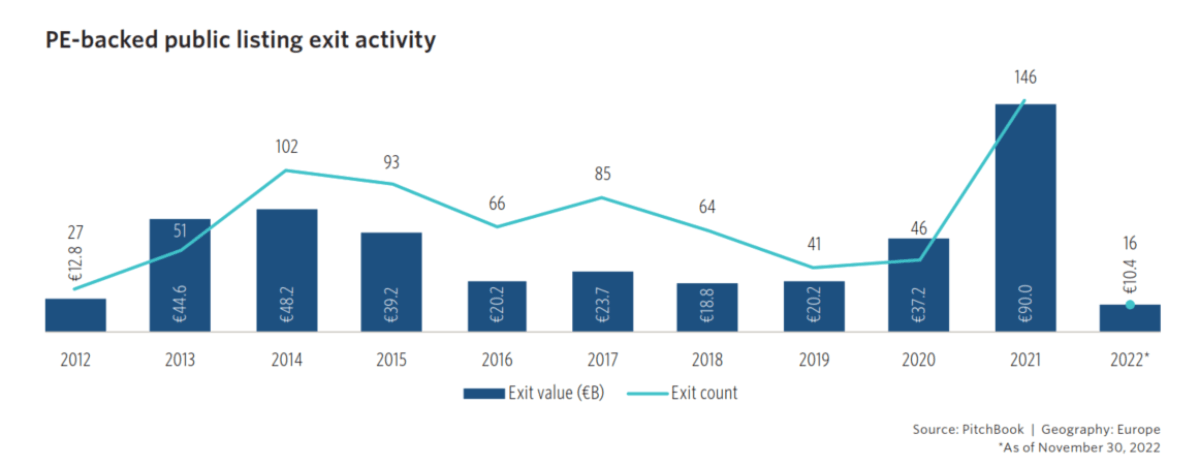

Public listings will remain unpopular

Public listings have been sluggish in 2022, after significant levels of first post-pandemic activity. The unpopularity is primarily a result of low share prices in public markets. As an alternative, businesses may seek sponsor-to-sponsor buyouts or corporate acquisitions. Publicly listing a company is often a lengthy and expensive process and many businesses may wait out the storm.

However, with the economic volatility proving to have less bite than initially expected, this sentiment could evaporate. Historical data shows that public listings resume very quickly after a market downturn, thus investor demand will become clearer as 2023 wears on.

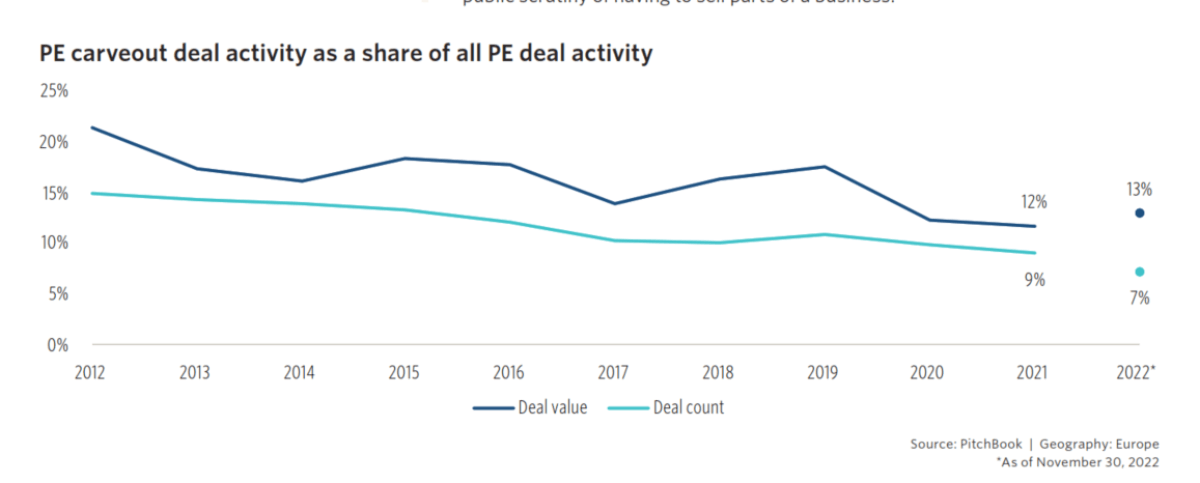

Carveout deals will account for 15% of aggregate PE deal value

The final takeaway from Pitchbook’s European Capital Outlook for 2023

Carveouts are a fantastic opportunity for companies and investors to raise capital from noncore assets. These deals are a prime opportunity for PE firms and will take up a bigger percentage of the deal activity in 2023. We have seen several high-profile carveouts taking place in 2022 and this trend is set to continue as wider deal activity flattens due to economic uncertainty.

Find your next Private Equity role with Marks Sattin Executive Search

If you are interested in European Private Equity, we may have an opportunity for you. At Marks Sattin Executive Search, we work with a wide range of private equity-backed and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped more than several professionals find their next exciting opportunity in private equity.

Apply for an available private equity job with us today or register your details to shortlist jobs so you never miss an opportunity.