Pitchbook's US Outlook 2024

Trends in the US investment market

Private market sentiment

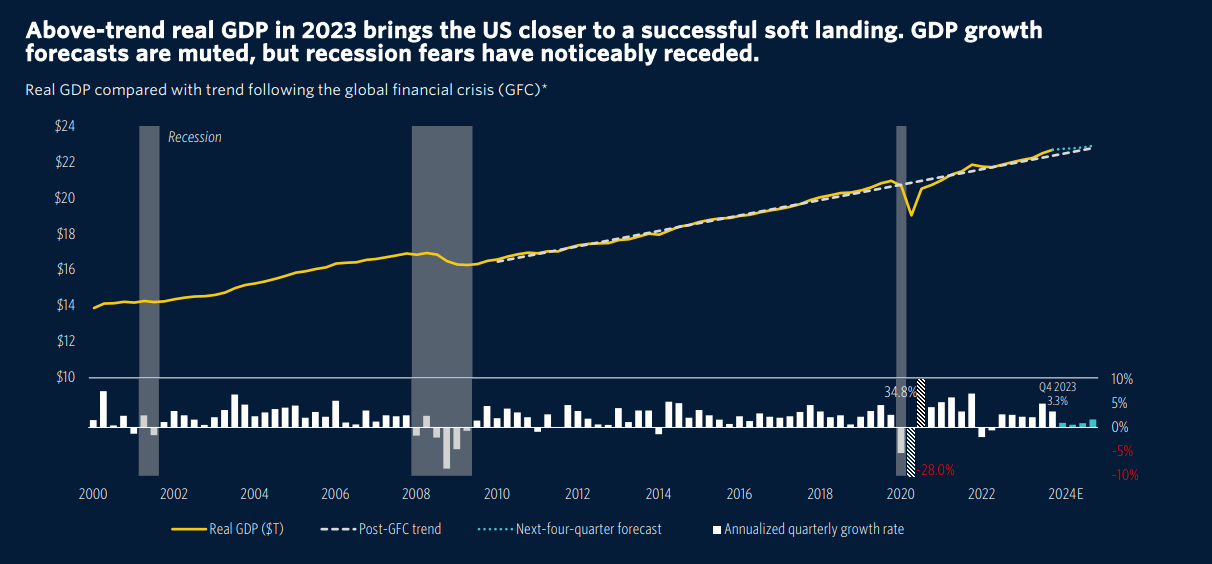

Recent GDP figures suggest that the economy is on track for a soft landing, which is good news for the private markets. This positive trend could bring hope to investors and potentially lead to an increase in deal activity. With the uncertainty of a downturn removed, there may be more confidence in making investments and pursuing opportunities. The engineering of a soft landing could provide stability and a favourable environment for growth in the private markets. This could be a promising sign for the future of the economy and could lead to increased activity in the deal-making space.

The impact of inflation on investors

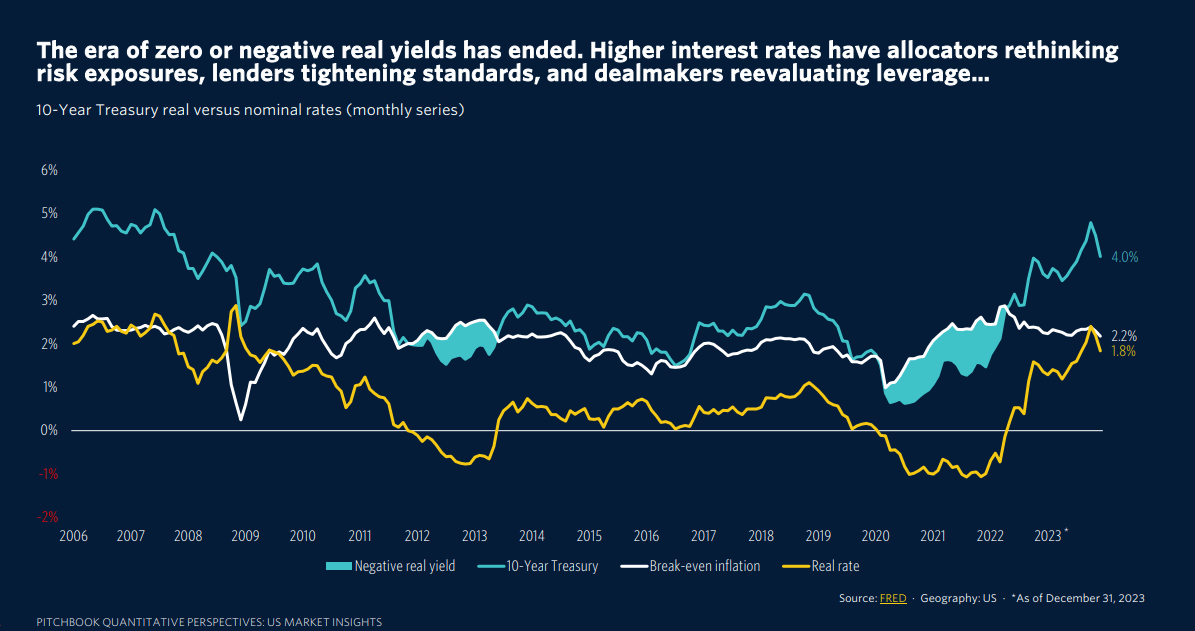

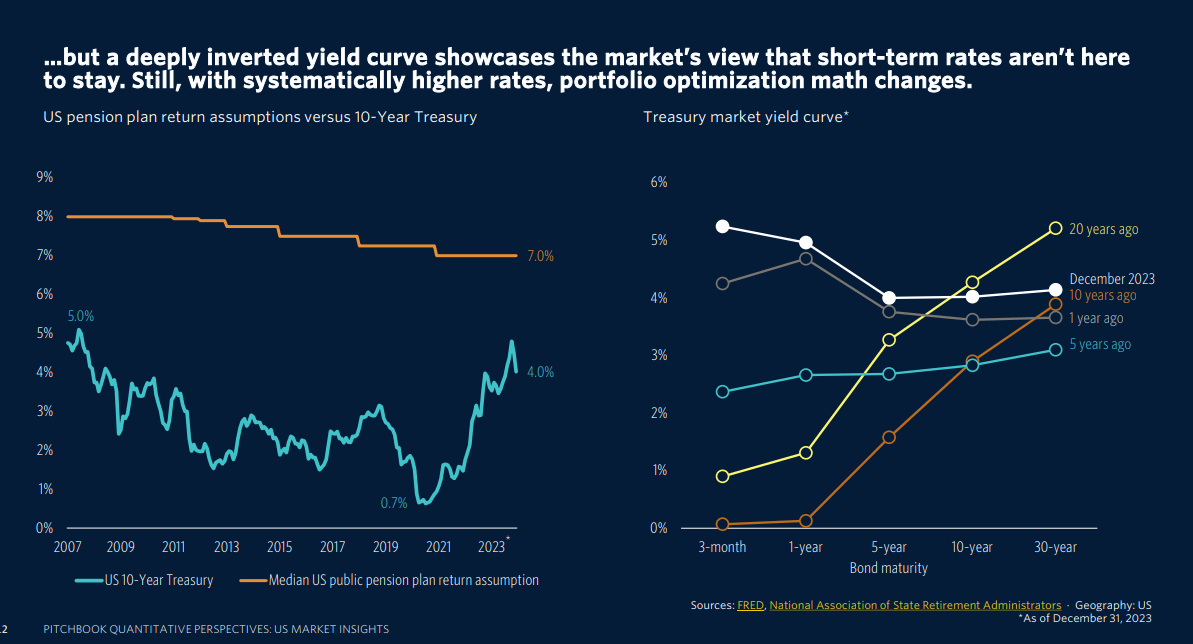

The increase in rates has had an interesting impact on investors. With rates rising, allocators may feel less pressure to seek out higher-risk assets to meet their return targets. While this may provide some relief for those looking to play it safe, it could have a negative effect on flows into venture capital (VC) and high-yield debt investments.

VC investments and high-yield debt are typically considered higher risk, higher reward options, and may not be as attractive to investors when safer options are available. This shift in investor behaviour could potentially impact the flow of funds into these areas, leading to a decrease in investment in VC and high-yield debt. Ultimately, the impact of the increase in rates on these sectors will depend on how investors react and adjust their strategies moving forward.

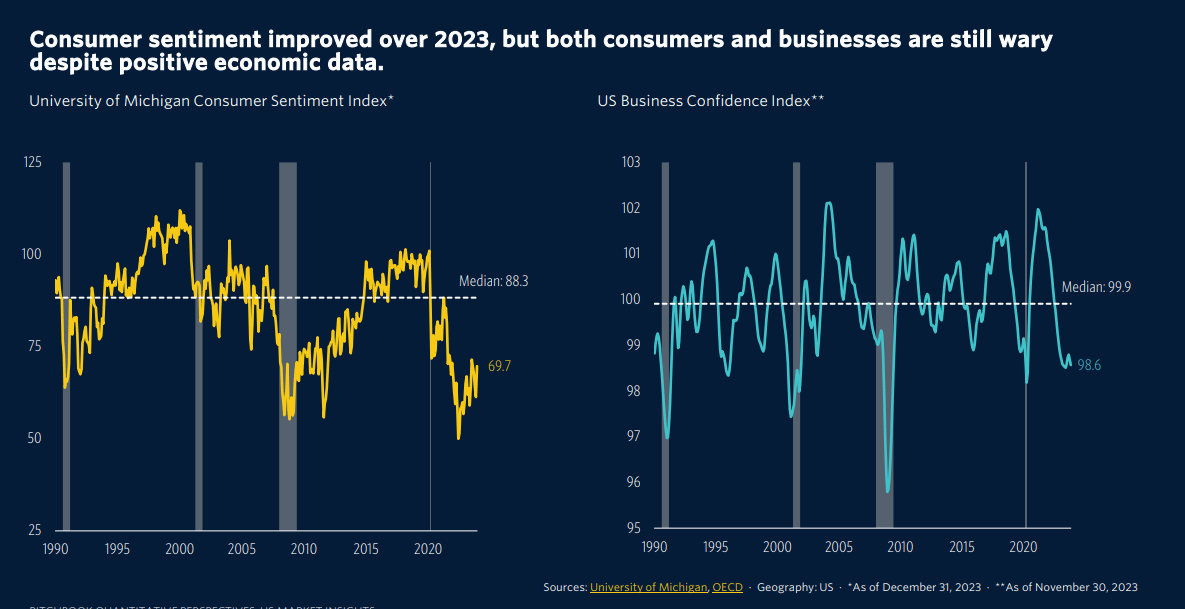

The impact of inflation on consumers

The possibility of three rate cuts in 2024 shows that the Fed is prepared to act if necessary to support economic growth and stability. Overall, while there are still challenges ahead, these recent developments suggest that the Fed is closely monitoring the situation and is ready to respond appropriately to address any potential risks.

Unemployment

A low unemployment rate also means that more people have stable income, which can help to mitigate the impact of rising prices on consumer spending. Additionally, when people are employed, they are more likely to make big-ticket purchases like cars and homes, which can help to stimulate economic growth. Overall, the stability of the job market is a crucial factor in preventing a full-blown recession and maintaining economic stability.

What does this mean for the US private equity and VC market

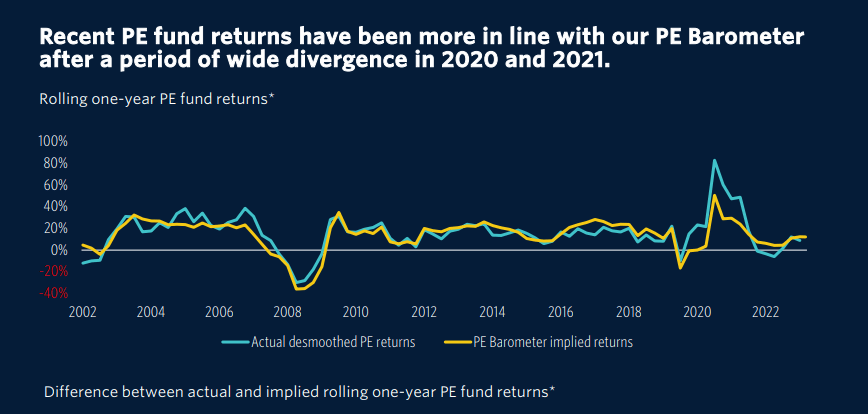

The Pitchbook PE Barometer is a factor-based framework that estimates PE fund returns based on key economic and market variables. Historically, it has tracked actual returns reasonably well. However, from late 2020 through 2021, PE fund returns were considerably higher than the implied returns from the PE Barometer. This performance gap reversed in early 2022 as fund managers gradually marked their valuations to market.

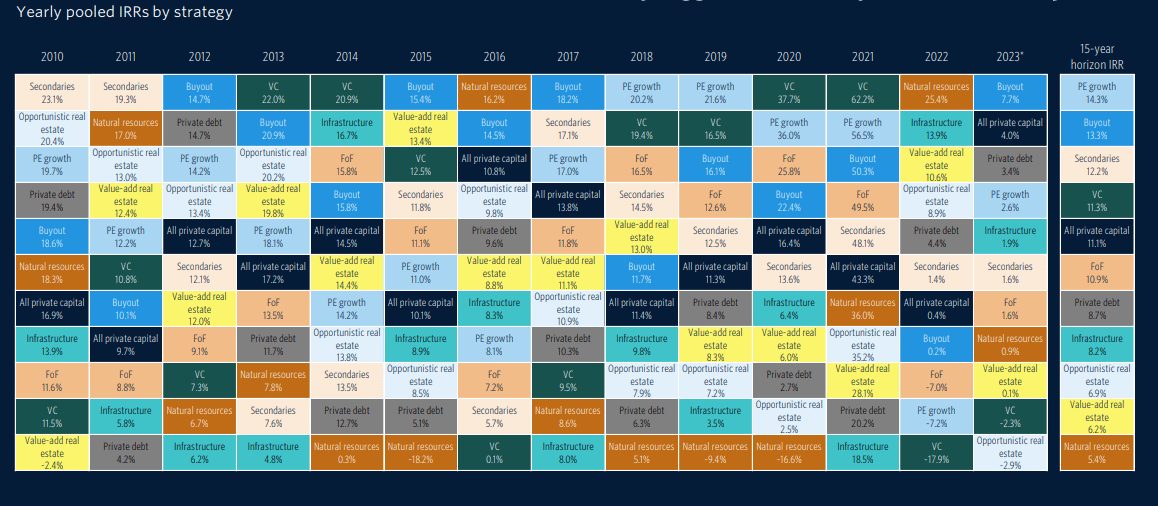

Since the anomalous years of 2020 and 2021, VC has fallen back as other strategies like private debt, natural resources, and infrastructure—traditionally laggards—recently landed in the top half.

What does this mean for CFO’s looking for their next opportunity in a US investor-led business?

Find your next investor-led CFO or Executive Finance role with Marks Sattin Executive Search

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped more than several professionals find their next exciting opportunity.

Apply for an available CFO or Executive Finance job with us today or register your details and we will contact you at the earliest convenience.