UK Private Capital Breakdown 2025

This analysis delves into the key trends shaping the UK's private markets, drawing on recent data from Pitchbook to provide a clear picture of the current climate. We will explore the nuances of VC deal flow, the subdued but steady nature of PE transactions, and the macroeconomic headwinds influencing decision-making across the board. From tax reforms to landmark government accords, we will unpack the critical factors that GPs and LPs must navigate.

The macroeconomic backdrop presents a cautious outlook

The UK's economic climate continues to exert significant pressure on private markets. The Organisation for Economic Co-operation and Development (OECD) has adjusted its growth projections downwards, forecasting 1.3% growth in 2025 and 1.0% in 2026. This cautious outlook is compounded by stubborn inflation, which rose to 3.6% in the second quarter.

In response, the Bank of England acted decisively, cutting interest rates three times so far this year to bring the base rate down to 4.00%. While these cuts aim to stimulate economic activity, the overall environment remains one of volatility. This has directly impacted investment and fundraising, prompting a more measured approach from both domestic and international investors.

Adding to the complexity are significant regulatory and legislative developments. The House of Lords Financial Services Regulation Committee launched an inquiry into the growth of private markets, signalling increased scrutiny. Furthermore, new systems like the Private Intermittent Securities and Capital Exchange System (PISCES) are being explored to enhance liquidity, potentially transforming how private assets are traded.

Venture Capital: resilience and realignment

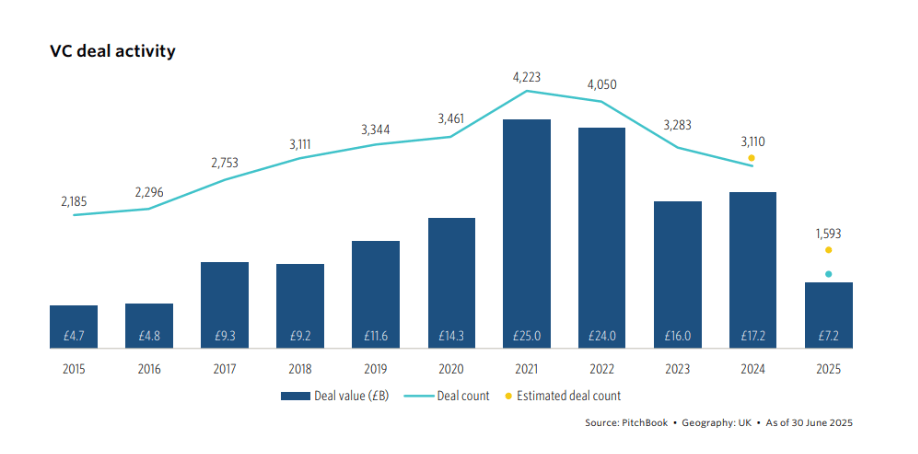

UK VC activity moderated in the first half of 2025 compared to the record-breaking pace of previous years. Total deal activity reached £7.2 billion, suggesting a potential 15.5% decrease for the full year compared to 2024. This slowdown reflects the broader market uncertainty and a more discerning approach from investors.

Despite the headline figures, certain segments have shown remarkable strength.

Pharma, Biotech, and AI lead the way

Series A and Series B funding rounds have emerged as the most resilient stages, now accounting for 65.5% of total deal value, a significant increase from 51.2% in 2024. This resilience is largely driven by sustained, strong deal flow into the pharma and biotech sectors. These industries continue to attract capital due to their long-term growth potential and non-cyclical demand.

Artificial intelligence, while slowing from the feverish pace of 2024, remains the leading sector for total investment. This demonstrates a continued belief in the transformative power of AI and its application across various industries.

Fundraising and exit activity

In contrast, VC exit activity has held steady. Robust merger and acquisition (M&A) momentum has provided a reliable exit pathway for many investors, even amidst market volatility. Another key development is the growing prominence of direct secondaries, which are reshaping liquidity options. The UK now leads Europe in both the volume and penetration of these deals, offering GPs and LPs a vital alternative for realising returns.

Private Equity: a shift towards smaller, strategic deals

The UK private equity market tells a similar story of adaptation. While the total value of PE deals in H1 2025 was subdued, falling 5.3% compared to H1 2024, the number of transactions surged by 19.2%. This indicates a clear appetite for smaller, more strategic acquisitions rather than large-scale megadeals.

The rise of buyouts and US Capital

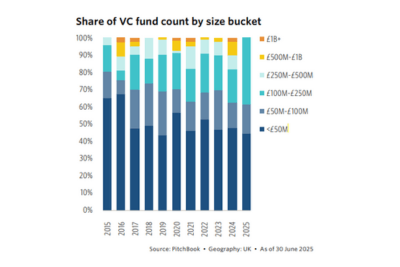

For the first time since 2021, buyouts have accounted for the majority of deal value. The mid-market segment, particularly deals in the £500 million to £1 billion range, has been especially active, representing 35.1% of total value. This revival in the middle market is also buoying fundraising, with funds between £100 million and £5 billion raising more capital than in the prior three years.

The influence of US capital has become pivotal. American investors participated in half of the top 20 UK deals, and their share of the overall deal count has climbed to 31.3% in 2025. This highlights the enduring appeal of UK assets to international players.

The exit conundrum and tax headwinds

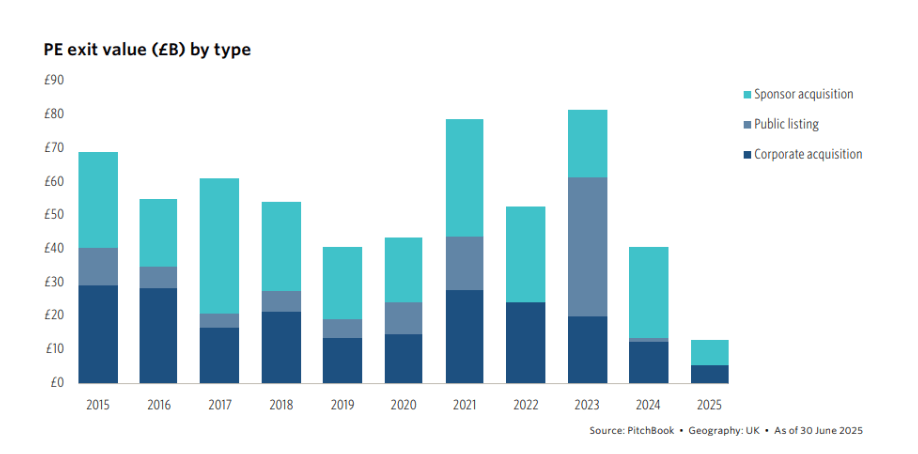

The most significant challenge facing the PE industry is on the exit front. H1 2025 exit value was down 12.1% from H1 2024, a year that was already more than 50% below 2023 levels. This has pushed the deals-to-exits ratio to 2.9x, contributing to a growing backlog of over 2,700 PE-backed companies awaiting an exit event.

This challenge is exacerbated by recent tax reforms. As of April 2025, the carried interest rate increased from 28% to 32%. This, combined with changes to the tax status of non-domiciled individuals, is reportedly prompting some GPs to consider relocating, potentially impacting the UK's talent pool and competitive standing.

Looking ahead: The Mansion House Accord and Future Outlook

A significant development with long-term implications is the Mansion House Accord. This agreement aims to unlock up to £50 billion for private markets by 2030 by encouraging pension funds to increase their allocation to unlisted equities. This initiative could provide a substantial, long-term capital injection into UK private equity and venture capital, supporting growth and innovation.

In the second half of 2025, the UK private capital market is at a crossroads. While macroeconomic pressures and a difficult exit environment present formidable challenges, the market is not static. The resilience of early-stage VC in key sectors, the strategic shift in PE towards smaller buyouts, and the potential infusion of capital from initiatives like the Mansion House Accord all point to a dynamic future.

Success in this environment will demand strategic acumen, deep sector expertise, and the ability to adapt to rapidly changing conditions. For both GPs and LPs, navigating this landscape requires a focus on value creation, operational efficiency, and identifying resilient pockets of growth.

Executive Search expertise for a changing market

At Marks Sattin, we partner with investor-led and privately-owned businesses to navigate complex market shifts with confidence. With over 30 years of experience, we have supported organisations across sectors in appointing CFOs and senior leaders who drive resilience, growth, and value creation. If you are considering strengthening your leadership team to meet the challenges of today’s private capital landscape, submit a brief and speak with us about how we can help.

Submit a brief