Our recruitment services cover Yorkshire and the North East

Established in 1988, Marks Sattin recruitment consultants are strategically based in nine office locations across the UK and Europe. Last year we placed over 1,500 professionals in new jobs across the finance, technology, change and legal disciplines.

The Marks Sattin Leeds team focuses on permanent, temporary and interim accountancy and finance recruitment across Yorkshire and the North East. We are highly experienced and are responsible for building some of the foremost finance teams in the region. Due to our great reputation, expertise and pedigree, we are the go-to recruitment agency for businesses looking to grow their teams.

📞Contact us on +44 (0)113 242 8177 📧Leeds@markssattin.com 📍Minerva House, 29 E Parade, Leeds LS1 5SP

Submit a brief

Did you know that Leeds is home to the Jelly Tot and the world’s oldest working railway?

Did you know that Leeds is home to the Jelly Tot and the world’s oldest working railway?

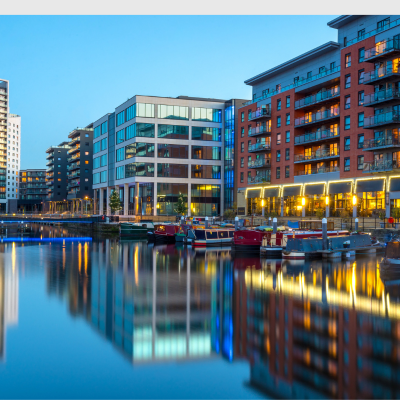

With its large and highly skilled population, incredible career opportunities, prestigious universities, excellent transport links, vibrant city centre and nearby countryside, Leeds offers fantastic opportunities rarely found elsewhere in the UK. These assets make Leeds a desirable place to live and work, as the region provides its people with a brilliant quality of life while excelling both professionally and personally.

Whilst we are based in Leeds, our candidate and client network reach far beyond the city boundaries. We have long-standing relationships with jobseekers and businesses in Harrogate, York, Newcastle and Bradford and have placed tens of thousands of professionals in a range of businesses.

Keeping businesses safe

Our teams, focused on implementation, compliance and governance, collaborate intensively with IT gurus and legal authorities. We seamlessly operate as your silent protectors.

Technology to enhance performance

Truth is embedded in data, which is why it forms the crux of our hiring procedures. We collect valuable information responsibly at various levels such as talent distribution, market awareness, performance metrics, application management, system enhancement, and prospective employee attraction analysis.

Recruitment, wherever, whenever

Whether you find yourself in the heart of the Yorkshire Dales, nestled in the Wolds, along the Humber, from Hull to Sheffield, from Leeds to York and throughout the expansive region, rest assured, we've got you covered. With nine offices situated across the UK, we're on hand to support those with multiple locations or those considering expansion into fresh territories. We've been providing unwavering service like this since 1988.

-

Temporary Recruitment in Leeds

- When hiring in niche industries, talent can be hard to find. Our approach to temporary work has speed at its heart. We are confident we can connect temporary talent to temporary positions in Leeds, and across Yorkshire. Often our extensive networks mean we do not need to go to the open market to fill positions.

Permanent Recruitment in Leeds

- We use strategic sourcing techniques, targeted networking, and personalised outreach. We proactively engage with passive candidates with the expertise and experience your organisation needs. We aim to identify and attract exceptional professionals who might not be found through conventional job postings. The candidates we work with enjoy a thorough, comprehensive process where our objective is to give a high level of service not just look to please.

Volume Temporary Recruitment

- When you need a volume of hires you should expect a solution which delivers time and time again. On time, in budget, effective temp supply built around your needs.

-

Volume Permanent Recruitment

- Often referred to as RPO (Recruitment Process Outsourcing) this can be a path for organisations whose internal recruitment teams are at capacity or trying to drive value. At times of hiring more than 1 or 2 people a project approach can be perfect. We can stand up teams to act as your talent supplier for the times you need them.

The roles we recruit for in Leeds

Executive Search: CFO, Finance Director, Head of Finance.

Management: Tax Manager, FP&A Manager, Treasury Manager, Business Controller, Financial Controller, Comm Fin Manager.

Part Qualified & Qualified: FP&A Analyst, Finance Analyst, Group Accountant, Financial Accountant, Tax/ Statutory Accountant, Finance Business Partner, Management Accountant.

Transactional Finance: Payroll, Credit Control, Accounts Payable, Accounts Assistant, Accounts Receivable, Assistant Accountant, Assistant Management Accountant.

The roles we recruit for in Leeds

Executive Search: CFO, Finance Director, Head of Finance.

Management: Tax Manager, FP&A Manager, Treasury Manager, Business Controller, Financial Controller, Comm Fin Manager.

Part Qualified & Qualified: FP&A Analyst, Finance Analyst, Group Accountant, Financial Accountant, Tax/ Statutory Accountant, Finance Business Partner, Management Accountant.

Transactional Finance: Payroll, Credit Control, Accounts Payable, Accounts Assistant, Accounts Receivable, Assistant Accountant, Assistant Management Accountant.

Client Success Stories in Yorkshire

McCain Foods, a global leader in frozen food products, has a significant presence in Yorkshire, where it operates one of its largest production facilities. Their presence in Yorkshire not only supports the local economy by providing numerous jobs but also emphasises sustainable practices in its operations. We were tasked with supporting them on various contingency contract roles including:

- Supply Chain Analyst

- FP&A Accountant

- Finance Business Partner

- Divisional Finance Director

Card Factory PLC – Card Factory PLC is a leading UK retailer specialising in affordable greeting cards, gifts and celebration products. Established in 1997, the company designs and manufactures many of its products in-house, offering value and strong market presence. We were tasked with supporting them with a number of roles including:

- Commercial Finance Analyst

- Management Accountant

- Project Accountant

- Head of Management Accounts

- Head of Financial Accounts

We supported the recruitment of 20 finance roles, with leading sofa retail group DFS.

Role types included:

- Multiple Senior Finance Business Partners

- Multiple Junior-mid level Finance Business Partners/Analysts

- Financial & Management Accountants

- Finance Projects roles – both interim & perm

Current job vacancies in Leeds

Salary:

£50,000 - £55,000 per annum

Location:

Leeds, West Yorkshire

Industry

Business Services

Qualification

Finalist / Newly qualified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Newly Qualified Finance

Contract Type:

Permanent

Description

Management Accountant Permanent | Competitive salary | Growing UK business

Reference

192268

Expiry Date

01/01/01

Author

Elizabeth Howe

Author

Elizabeth HoweSalary:

£32,000 - £35,000 per annum

Location:

Leeds, West Yorkshire

Industry

Business Services

Qualification

None specified

Market

Commerce & Industry

Salary

£35,000 - £40,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Accounts Receivable Team Leader

Reference

BBBH192872

Expiry Date

01/01/01

Author

Cameron Walsh

Author

Cameron WalshSalary:

£45,000 - £53,000 per annum + Hybrid, flexi time, healthcare

Location:

Bradford, West Yorkshire

Industry

Media & Communications

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Newly Qualified Finance

Contract Type:

Permanent

Description

Qualified Management Accountant role working for one of the major businesses that this company owns with genuine progression opportunities.

Reference

LGH18852

Expiry Date

01/01/01

Author

Laura Gunby

Author

Laura GunbySalary:

£30,000 - £35,000 per annum

Location:

Leeds, West Yorkshire

Industry

Business Services

Qualification

None specified

Market

Commerce & Industry

Salary

£35,000 - £40,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Management Accountant - East Leeds - £35k

Reference

BBBH192724

Expiry Date

01/01/01

Author

Cameron Walsh

Author

Cameron WalshSalary:

£35,000 - £42,000 per annum

Location:

Horsforth, West Yorkshire

Industry

Consumer & Retail

Qualification

Part qualified

Market

Commerce & Industry

Salary

£40,000 - £50,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Group Assistant Accountant Leeds | Full‑time | Competitive salary | Global finance exposure

Reference

192766

Expiry Date

01/01/01

Author

Elizabeth Howe

Author

Elizabeth HoweSalary:

£50,000 - £52,000 per annum

Location:

Leeds, West Yorkshire

Industry

Business Services

Qualification

Finalist / Newly qualified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Newly Qualified Finance

Contract Type:

Permanent

Description

Financial Accountant Leeds City Centre | Competitive salary + benefits | International, fast‑growing environment

Reference

190128

Expiry Date

01/01/01

Author

Elizabeth Howe

Author

Elizabeth HoweSalary:

£48,000 - £53,000 per annum

Location:

Bradford, West Yorkshire

Industry

Technology

Qualification

Finalist / Newly qualified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Newly Qualified Finance

Contract Type:

Permanent

Description

Finance Manager - Management Accounts Bradford | Competitive salary + benefits | Fast‑growth, tech‑enabled business

Reference

192784

Expiry Date

01/01/01

Author

Elizabeth Howe

Author

Elizabeth HoweSalary:

£50,000 - £55,000 per annum

Location:

Leeds, West Yorkshire

Industry

Energy, Resources and Industrial

Qualification

Finalist / Newly qualified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Newly Qualified Finance

Contract Type:

Permanent

Description

Senior FP&A Analyst Leeds | Competitive salary + benefits | Global growth environment

Reference

192825

Expiry Date

01/01/01

Author

Elizabeth Howe

Author

Elizabeth HoweSalary:

£35,000 - £40,000 per annum

Location:

Leeds, West Yorkshire

Industry

Energy, Resources and Industrial

Qualification

Part qualified

Market

Commerce & Industry

Salary

£40,000 - £50,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Junior Management Accountant Leeds | Up to £38,000 + benefits

Reference

192512

Expiry Date

01/01/01

Author

Elizabeth Howe

Author

Elizabeth HoweSalary:

Up to £31,000 per annum

Location:

Leeds, West Yorkshire

Industry

Business Services

Qualification

None specified

Market

Commerce & Industry

Salary

£30,000 - £35,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Finance Service Desk Analyst - Leeds

Reference

BBBH192867

Expiry Date

01/01/01

Author

Cameron Walsh

Author

Cameron Walsh