Key trends shaping the 2025 European Private Capital Market

In December 2024, pitchbook shared six key predictions in our 2025 EMEA Private Capital Outlook. Now, as we reach the halfway point of the year, this article offers a brief overview of how those trends are unfolding. The private markets have faced a mix of challenges, including tighter liquidity and strategic adjustments as well as new opportunities. Here, we revisit their key themes and provide a snapshot of how they’re shaping private capital activity so far in 2025.

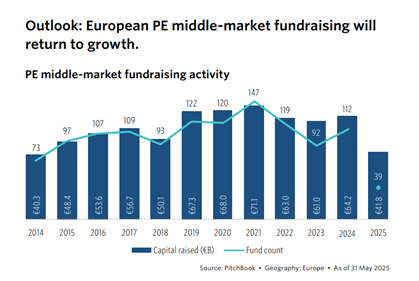

Middle-market fundraising

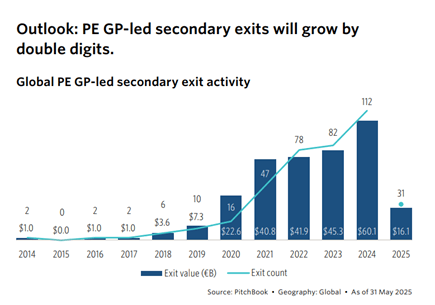

Rise of GP - led secondary exits

The landscape of private equity exits is evolving, with GP-led secondary exits taking centre stage. These transactions allow General Partners (GPs) to provide liquidity to Limited Partners (LPs) while retaining control over high-potential assets. The trend has gained traction due to better structuring guidelines and the need for liquidity in a volatile market. Despite a slow start in 2025 attributed to geopolitical uncertainties and tariff policies, the popularity of GP-led secondary exits is expected to grow. New entrants like Ardian and Inflexion are setting the stage for a dynamic year, with potential exit values poised to reach $66 billion globally.

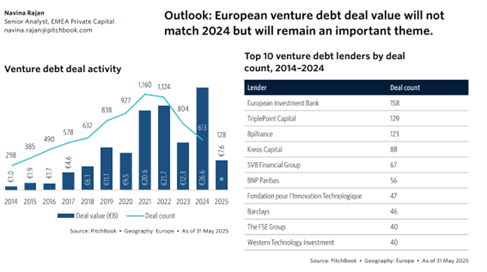

The growing role of venture debt

Venture debt has become an increasingly important asset class within the European venture ecosystem. In 2024, a record €26.6 billion in venture debt deals was achieved, with companies opting for this form of non-dilutive financing to extend cash runways without compromising equity. While 2025 is unlikely to surpass these levels, venture debt remains a crucial theme. The first half of the year has already seen significant deals like the €1.4 billion refinanced by United Petfood and €1 billion raised by FINN, emphasising the continued reliance on venture debt amid uncertain equity markets.

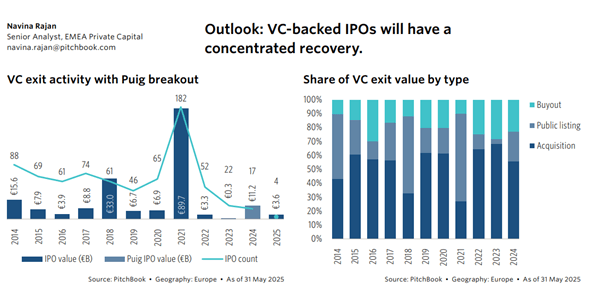

Concentrated recovery of VC-backed IPOs

The European IPO market, particularly for VC-backed companies, is experiencing a concentrated yet significant recovery. After a tepid 2024, which saw IPO values dominated by a single listing, 2025 shows promise. The first half of the year has already generated €3.6 billion from just four exits. Although this recovery is concentrated, it underscores a renewed investor interest in IPOs. Key listings such as Klarna could further boost activity, though geopolitical volatility remains a potential dampener. The opening up of IPO markets could offer much-needed liquidity to venture capital stakeholders and invigorate the broader market.

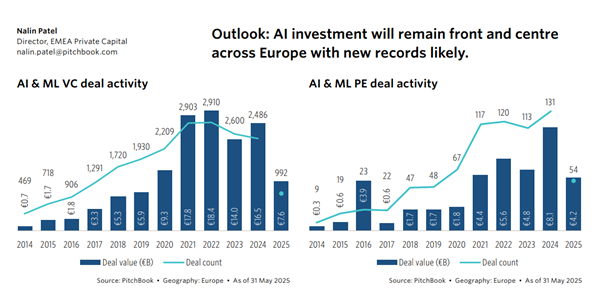

AI Investments leading the charge

Artificial Intelligence (AI) continues to be a focal point for investment across Europe. With applications spanning various industries, AI is attracting significant capital. By mid-2025, €7.6 billion in venture capital (VC) and €4.2 billion in private equity (PE) have been invested in AI deals. Highlighting this trend are substantial transactions like the €1.4 billion buyout of Metaphysic and Google DeepMind's €536 million raise for its spin-off, Isomorphic Labs. The rapid advancements and diverse applications of AI, from content creation to drug discovery, are driving this investment boom. The European Union's AI regulatory framework further supports this growth, aiming to position Europe as a leader in AI innovation.

Impact of Geopolitical and Economic factors

Geopolitical and economic factors are playing a pivotal role in shaping the European private capital market in 2025. The lingering effects of US tariffs, political instability, and macroeconomic uncertainties are creating a complex landscape for investors. These factors have led to a cautious approach in deal-making and fundraising activities.

However, they also present unique opportunities. Investors are increasingly looking beyond traditional markets, exploring emerging sectors and regions. The Middle East and North Africa (MENA) region, for instance, is becoming an attractive destination for capital flows, driven by favourable policies and ambitious projects like Saudi Vision 2030. While challenges persist, the evolving geopolitical and economic environment continues to shape investment strategies and opportunities in the private capital market.

Are you a fund looking for a heavy weight CFO or finance leader for your investor-led business?

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately-owned businesses across all sectors and locations. With over 30 years of experience, we have helped a number of organisations find their next CFO. If you would like to speak to us about hiring a CFO for your portfolio or your owner-managed business, please don’t hesitate to submit a brief.