The latest in the UK private equity market: Potential recovery in UK deal making

We have already discussed the recent key trends in European and US private equity (PE) market’s at length, but what is happening closer to home?

In light of the Bank of England maintaining the current 5.25% interest rate, and consumer price inflation coming down, fears of a recession in the UK are abating. In order to effectively evaluate the key trends in the UK PE investment market, we have reviewed Pitchbook’s latest in UK Private Capital Breakdown.

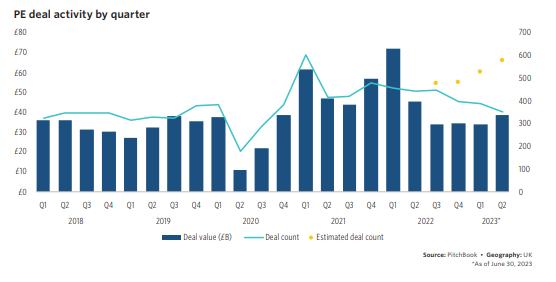

In Q2 2023, the UK private equity industry welcomed signs of a potential recovery in deal making as evidenced by an increase in deal value and estimated deal count. This is attributed to tighter monetary policies that have caused PE sponsors to adopt a more considered approach towards deals. As such, there has been a rise in smaller deals ranging from £100 million to £500 million, with financial services being the most active sector.

Moreover, UK PE exit value has been on an upward trend for four consecutive quarters and is expected to continue due to high value exits exceeding £1 billion. However, this is not without its challenges as leveraged buyouts (LBOs) have become costlier, and the initial public offering (IPO) market remains muted. Despite this, UK PE fundraising is on track for a record-breaking year with the contribution of large funds from experienced buyout managers.

Growth in the UK PE market

In the second quarter of 2023, UK private equity deal value increased by 13.2% compared to the previous quarter, indicating a potential recovery in UK dealmaking. Despite this positive trend, deal value is still significantly lower than last year's figure. The UK's macroeconomic climate has been characterised by high inflation and interest rates, with GDP growth projected to be lower than other G7 economies.

Small deals are on the rise

Considering the current macroeconomic challenges, private equity investors have become more cautious and focused on thorough due diligence when approaching deal making. This has resulted in a trend towards smaller deals, with those worth between £100 million and £500 million making up most transactions in the UK.

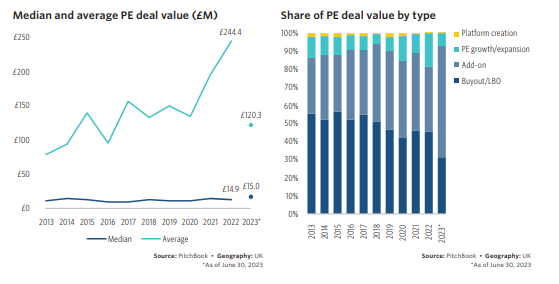

General partners have also been hesitant to pursue megadeals exceeding £2.5 billion, with only one such deal announced so far in 2023. This shift towards smaller deals is reflected in the average deal size of £120.3 million, which is half of the average deal size seen in 2022, and marks a seven-year low.

In uncertain market conditions, add-on deals have become increasingly popular, making up over 60% of total deal value in 2023 so far. A notable example is the acquisition of petrol station operator EG Group by British supermarket chain Asda for £2.3 billion, highlighting the appeal of add-on deals during times of market uncertainty.

Overall, despite the challenges presented by macroeconomic headwinds, private equity sponsors are adapting and finding success through careful deal making strategies. So, it is likely that they will continue to see a focus on smaller deals and add-ons in the coming months.

Take privates and carveouts remain popular in the UK

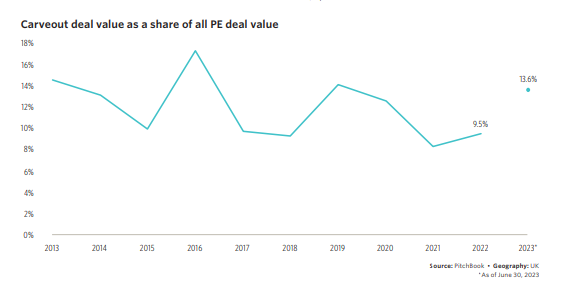

The continued popularity of take-privates and carveouts in the UK market is driven by two key factors. The first is the current timing, with lower equity valuations making it more attractive for PE sponsors to acquire publicly listed companies. The second factor is structural, with increasing criticism of the LSE's regulations and competitiveness compared to other exchanges. This trend is expected to continue, as demonstrated by a significant increase in take-private and carveout deals in the first half of 2023.

These deals not only provide opportunities for PE sponsors but also contribute to the overall strength of the European PE market, despite macroeconomic challenges. Additionally, companies are increasingly turning to carveouts to optimise their balance sheets and create synergies between portfolio companies. This trend is expected to continue, and carveouts are likely to represent a significant share of PE deal value in the future.

Financial Services in London are bouncing back

PE fundraising activity in the UK

In 2022, despite a tough macroeconomic climate and global fundraising slowdown, the UK PE market has proven to be the most resilient in Europe. In H1 2023 alone, it saw 22 funds close on over £30 billion, almost matching the total raised in both 2020 and 2021 combined.

This is thanks to three large funds from experienced buyout managers, accounting for 78.3% of the capital raised YTD. As a result, the average and median fund sizes have increased significantly from 2022 figures. This trend is expected to continue in H2 2023, potentially making it a record year for UK PE fundraising. This reinforces the strong reputation of UK-based private equity firms and their ability to weather challenging market conditions.

Final thoughts

Overall, the future looks promising for the UK PE market, with its proven resilience and continued success in fundraising.

This is a testament to the strength and expertise of UK-based private equity managers, who continue to attract significant amounts of capital from investors globally. As the year progresses, it will be interesting to see how this trend evolves, and how the UK PE market continues to thrive.

Find your next investor-led CFO or Executive Finance role with Marks Sattin Executive Search

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped several professionals find their next exciting opportunity in private equity.

Apply for an available CFO or Executive Finance job with us today or register your details to shortlist jobs so you never miss an opportunity.