What’s next in the UK venture capital market?

The UK's macroeconomic landscape continues to present a mixed picture, with some indicators showing signs of improvement while others remain concerning. Inflation, as measured by the Consumer Price Index, has slightly decreased to 6.8% in July. However, wage growth remains at record levels. This is higher than inflation rates in both the US and the eurozone, which stood at 3.2% and 5.3%, respectively, in July.

GDP growth in the UK has remained stagnant, with the economy narrowly avoiding a recession thus far. Meanwhile, interest rates have continued to rise, reaching 5.25% in July. This has sparked concerns about a recession and its potential severity. The current consensus is that a recession may occur in 2024, with expectations of further rate hikes throughout the remainder of this year.

How do these economic factors impact the venture capital market?

The first half of 2023 saw a decrease in UK venture capital (VC) deal value compared to the same period in 2022, aligning with the overall trend seen across Europe. However, there was an increase in Q2 2023, giving hope for potential recovery in the rest of the year.

As with all financial markets, higher interest rates play a significant role in shaping activity. Higher base rates lead to higher hurdle rates for returns and increased benchmark rates based on risk-free rates. This means that fund managers will need to work harder to outperform these benchmarks, and investors will only be interested in strategies that can achieve this.

Moreover, higher interest rates also result in higher discount rates for company valuations and increased borrowing costs for deals. In an environment where all boats are impacted by a rising tide, later-stage firms, and sectors with limited paths to profitability and capital efficiency may face more significant challenges. While no one is immune, earlier-stage firms tend to be more resilient in such circumstances.

Overall VC deal value continues to fall, but up QoQ

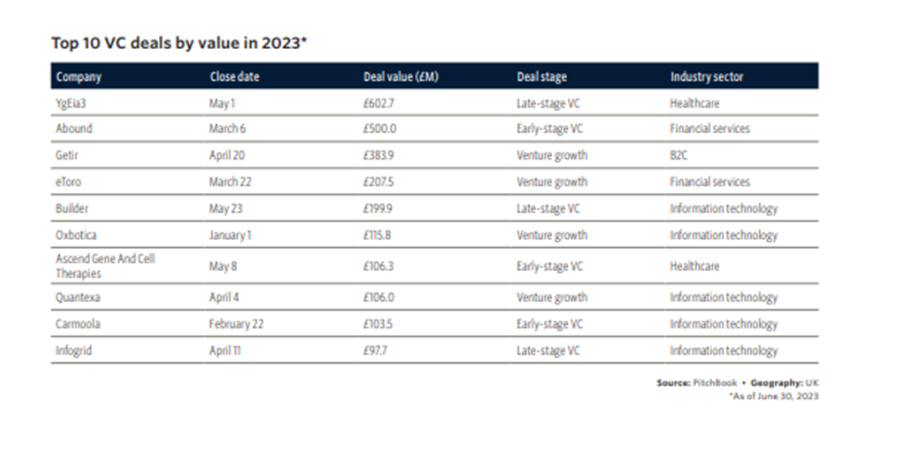

The largest deals in H1 2023 were a mix of stages and sectors, with four being venture-growth deals. The top deal was made by wellness testing startup YgEia3 for £602.7 million, which was quickly followed by consumer finance firm Abound's £500 million deal and Mubadala Investment's £383.9 million investment in on-demand grocery player Getir. This demonstrates the diverse range of industries that are attracting significant investment in the UK VC market.

Despite the overall decline in deal activity, these large deals highlight the potential for growth and opportunity within specific sectors. As we move into the second half of 2023, it will be interesting to see how these trends continue and whether a sustained recovery is achievable.

The healthcare sector is showing resilience

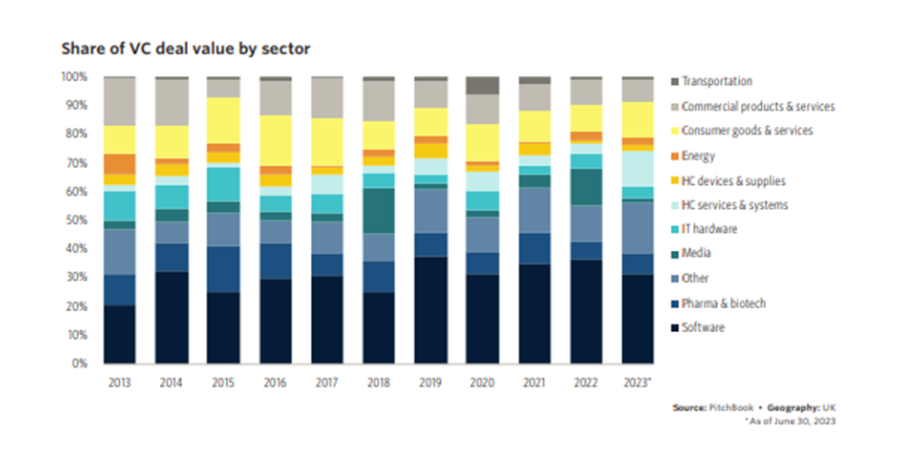

In Pitchbook’s latest report on the state of investment activity in the UK, the latest deal value data for H1 2023, broken down by sector, paints an interesting picture. Media and IT hardware have seen a significant slowdown since H2 2022, while healthcare has shown remarkable resilience both sequentially and compared to last year.

In particular, the media landscape saw a decrease in deal activity from its peak levels in 2022. This decline was attributed to the large investment of £3.2 billion into sports media company DAZN in H1 2022.

On the other hand, healthcare sectors in the UK have fared better. The deal value for HC services & systems in H1 2023 is higher than both H1 and H2 2022 levels, and the deal value for HC devices & supplies is only 6.9% lower compared to the same period last year.

This can be explained by the lower levels of valuation inflation seen in the healthcare sector in 2022, compared to sectors such as software and IT hardware which saw peak levels of activity. This means that the healthcare sector has a lower base of activity to grow from this year.

Moreover, the noncyclical nature of the healthcare sector also plays a role in its resilience. The demand for technologies and services in this space is expected to remain strong even during periods of market weakness, making it an attractive sector for investment. As we continue to navigate through challenging times, it will be interesting to see how these trends develop and shape the landscape of deal activity in the coming months.

Overall, while certain sectors may experience difficulties, healthcare remains a steady and resilient sector with potential for growth and investment. This highlights the importance of diversifying portfolios and looking beyond short-term performance when making investment decisions. With its strong fundamentals and potential for long-term value creation, the healthcare sector continues to be a key player in the overall deal market despite the current economic climate.

Venture capital exits in the UK

The first half of 2023 has seen a decrease in VC exit value compared to previous years. However, this does not necessarily indicate a lack of activity in the market, as exit count remains stable. There are also potential signs of recovery, with an increase in exit value observed in Q2 2023.

It is important to note that while the VC investments/exits ratio has increased from its low point in 2021, it is still lower than the historical average. This suggests that there may still be a higher number of investments compared to exits in the UK market.

Going forward, it will also be important to track how government policies and initiatives may impact the VC market. With initiatives such as the Future Fund and the UK Innovation Investment Fund, there may be potential for increased investment opportunities and support for startups in the coming years.

Venture capital fundraising in the UK

In the first half of 2023, UK VC fundraising reached £2.5 billion, representing an increase to 36.4% from the previous year. This trend is also reflected in European H1 fundraising figures which stood at 31.6% in comparison to last year's value.

To adapt to the tougher fundraising landscape, managers are becoming more capital efficient by directing funds towards strategies that exhibit higher returns. In line with this, LPs are also shifting their focus towards ventures that show potential for early-stage success.

The government's recent announcement of a £75 billion injection into VC funding is a significant move, but its impact remains uncertain. This plan aims to allocate 5% of assets from the top nine UK pension funds to invest in private startups by 2030. This could potentially lead to an additional £50 billion of capital from defined-contribution schemes, supplementing the existing local government pension scheme allocations and supporting investment in the region.

However, it is yet to be seen how these reforms will impact the growth of UK companies, especially in later-stage areas where government incentives have traditionally focused on early-stage ventures. More details on the deployment of funds are pending in a scenario where maximising returns has become a top priority for investors. Overall, the UK VC landscape is showing resilience, with an inclination towards early-stage investments and potential government support for growth in the market.

However, it remains to be seen how these developments will shape the future of VC funding in the country. As always, investors and managers must stay agile and adapt to changing market conditions to secure successful outcomes for all stakeholders involved. In the ever-evolving world of VC, it is important to keep a close eye on emerging trends and developments to make informed decisions and drive growth in the industry.

Find your next investor-led CFO or Executive Finance role with Marks Sattin Executive Search

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped several professionals find their next exciting opportunity in private equity.

Apply for an available CFO or Executive Finance job with us today or register your details to shortlist jobs so you never miss an opportunity.