Pitchbook's 2024 European Private Capital Outlook

Pitchbook's 2024 European Private Capital Outlook whitepaper provides a comprehensive analysis of the past year's trends and its impact on private equity and venture capital in Europe. Despite the challenges posed by market uncertainty in 2023, the report suggests that there is potential for growth and development in these asset classes in the coming year.

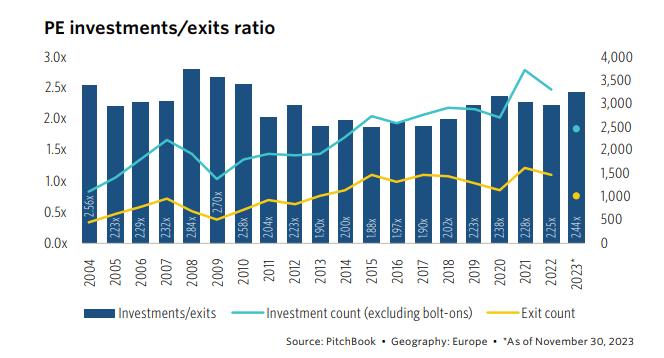

One of the key highlights of the report is the slower dealmaking activity in Europe in 2023, with a notable decline in venture capital deals compared to private equity. However, it is important to note that this is not indicative of a collapse, but rather a correction after the unprecedented levels of activity seen in 2021 and 2022.

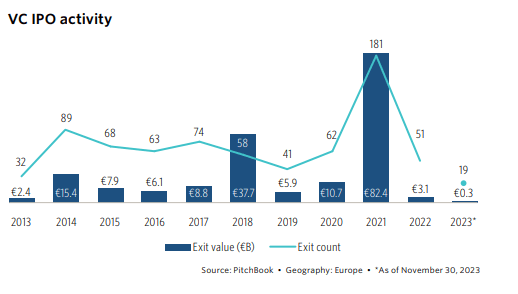

In terms of exits, the IPO of UK-based Arm stands out as a major liquidity event in 2023, while VC-backed public listings have faced challenges due to the modest share prices of previously backed companies. This can be attributed to macroeconomic factors such as inflation and weak economic growth.

The European PE investments/exits ratio will reach a 15-year high due to a muted exit market stemming from price dislocation

Another factor to consider is the potential impact of Brexit on the European private capital market. With the UK's departure from the EU, there may be changes in regulations and policies that could affect dealmaking and exits for European private equity firms. Furthermore, the shift towards sustainable investing is also expected to have an impact on the private capital landscape in Europe. As investors become more conscious of their environmental and social impact, they may demand higher standards from private equity firms, potentially affecting investments and exits.

Finally, the rise of technology and digital disruption in various industries could also impact the private capital market in Europe. As traditional business models are challenged by modern technologies, private equity firms may need to adapt and invest in new areas to stay competitive.

Overall, according to Pitchbook, while the current macroeconomic conditions are a major factor in shaping the 2024 European private capital outlook, there are also other potential risks and opportunities that could impact the industry. It will be crucial for firms to stay informed and agile to navigate these changes and make strategic investment decisions.

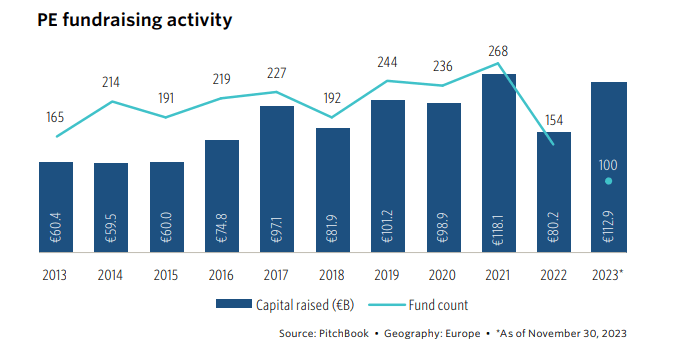

PE fundraising concentration in the top three funds will hit a record percentage as fundraising drops from 2023 levels due to macro headwinds

The European private capital market has seen significant growth in recent years, with PE fundraising hitting a record high in 2023. However, despite this impressive feat, there are concerns about the sustainability of such growth and potential risks that may impact future fundraising efforts.

One key factor contributing to the success of PE fundraising is the presence of experienced managers with established histories and strong relationships with clients. These factors have allowed them to navigate the challenging economic environment and continue to attract significant capital.

Looking ahead to 2024, it is expected that fundraising will decrease compared to the record levels of 2023. This can be attributed to a lack of exits, as well as higher interest rates making borrowing more costly for PE firms. If fundraising in 2024 drops below €100 billion, European fundraising will hit a record concentration in the top three funds.

Despite potential challenges, there are several factors that may continue to drive growth in the European private capital market. This includes an increasing number of institutional investors allocating to private markets and the potential for interest rate cuts to stimulate further fundraising.

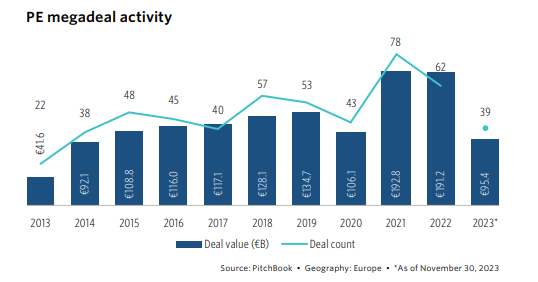

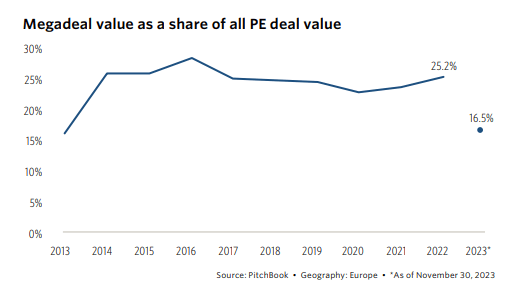

Megadeals will constitute less than 20% of overall PE deal value as uncertainty around the cost of debt persists

In the 2024 edition of their European Private Capital Outlook, Pitchbook highlights the trend of decreasing megadeals (deals worth €1 billion or more) in recent years and predicts that this will continue in 2024.

This is due to numerous factors such as the rising interest rate environment making it less favourable for large leveraged buyouts and a shift towards smaller, mid-sized deals. However, Pitchbook also notes that “the current macroeconomic landscape could lead to interest rate hikes levelling out and potentially even falling in 2024, which could result in larger deals closing”. Additionally, with several substantial PE funds having closed in 2023 and looking to deploy capital, there may be opportunities for megadeals to be revived in 2024. The potential for discounted valuations could also function as a catalyst for dealmaking, making it an interesting year ahead in the European private capital market.

There will be no meaningful recovery in the value and volume of VC-backed IPOs in 2024 as macroeconomic factors weigh on public markets.

With interest rates expected to remain high for the foreseeable future, there is a cautious outlook for IPOs and exit values. This has been evident in recent IPO performances of companies such as Arm, Ionos and Oddity Tech. As a result, companies may need to explore alternative means of extending their cash runways or raising new financing, such as cost-cutting measures or venture debt.

However, this does not mean that the pipeline for listings is dry. In fact, there are reports of prominent players like Huel and CVC Capital Partners considering IPOs, and when market conditions improve, the recovery in listings activity is expected to be strong. The challenge lies in predicting when this will happen, but if interest rate cuts are implemented next year, we could see a more favourable environment for tech company valuations and an increase in companies choosing to go public.

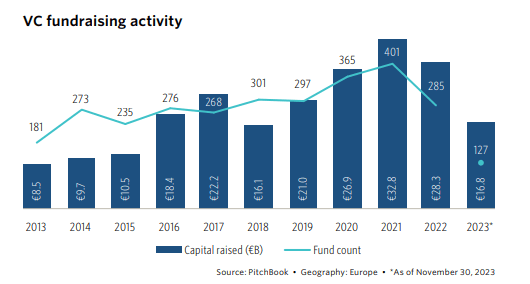

VC fundraising levels will at least match 2023 totals as recovery from trough levels begins, supported by larger vehicles

Pitchbook's whitepaper, suggests that despite weak returns in venture strategies and the uncertainty brought on by the pandemic, LPs are still interested in investing at the dip to optimize their returns. This is supported by the fact that over a longer time horizon of 15 years, venture has emerged as one of the top returning strategies. However, some LPs may remain cautious due to the current weak liquidity and exit markets in Europe.

The report also highlights that while acquisitions have taken a larger share of exits, the overall exit market could see improvement next year. This would not only support limited partner (LP) liquidity but also provide better returns. The total amount raised by the top 10 closes for this year has been €6.6 billion, which accounts for 39.2% of all capital raised so far. Looking at current fundraising dynamics, the top 10 open funds since 2020 have a potential to raise a total of €9.1 billion, exceeding the total amount raised by the top 10 closes in 2023.

However, due to the challenging fundraising environment in private markets, with lower levels of capital being raised and longer close times, it is expected that LP allocations to venture may remain low in 2023. This is further supported by the fact that venture has been one of the lower-performing strategies on a one-year horizon IRR, although its long-term returns are more promising. The presence of megafunds in the private equity space has also contributed to its higher levels of fundraising compared to venture. Additionally, with continued decline in valuations and uncertainty surrounding macro factors such as interest rates, LPs may remain cautious about making new investments.

Despite these challenges, it is worth noting that there will be more

fund closes in 2024, especially among smaller funds which could boost the

overall fundraising total. year.

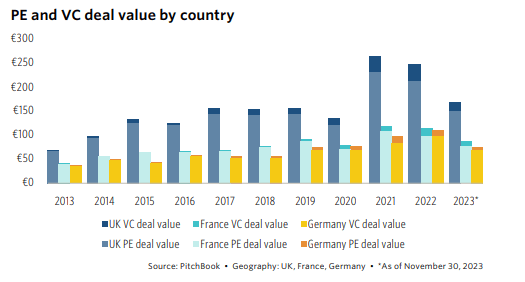

The UK will remain the European leader for private capital, but France and Germany could close the gap amid a challenging geopolitical landscape

The latest report from Pitchbook on the 2024 European Private Capital Outlook highlights the UK's continued dominance in private capital deal value. Despite challenges such as Brexit and the COVID-19 pandemic, the UK has consistently outperformed France and Germany in terms of private capital investments in recent years.

Meanwhile, other European nations like France and Germany are actively seeking to boost their private capital activity. France, in particular, is focusing on developing a strong tech ecosystem and may become a more attractive investment destination for private capital.

In addition, investors may look towards other less-saturated nations that offer fewer competitors and potentially lower asset prices. This could lead to a decrease in deal value for traditional private capital hubs like the UK and US.

Despite the potential challenges ahead, the UK is expected to maintain its lead in terms of deal value in 2024. The country has proven its resilience in the face of crises and has not lost ground in private market appetite. With a possible rebound towards target levels of inflation by late 2024, other nations may struggle to catch up with the UK's strong private capital investments.

Find your next investor-led CFO or Executive Finance role with Marks Sattin Executive Search

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped several professionals find their next exciting opportunity in private equity.

Apply for an available CFO or Executive Finance job with us today or register your details to shortlist jobs so you never miss an opportunity.