Pitchbook Healthcare 2024

Pitchbook’s Healthcare Fund Performance Update

As the private equity and venture capital sectors have developed and grown more competitive, managers and investors have increasingly focused on operational advancement and industry expertise. Healthcare stands out as a favoured specialisation due to its intricate regulatory systems, corporate arrangements, and revenue models, as well as the scientific precision required for thorough evaluation of technology prospects, especially within life sciences.

Moreover, a significant number of allocators are keen on gaining access to the healthcare sector due to its reputation for being resistant to economic cycles. As per Coller Capital, 87% of Limited Partners view healthcare and pharmaceuticals as appealing sectors for private equity investment in the upcoming two years. Furthermore, numerous LPs acknowledge the long-term trends and opportunities for innovation in the healthcare and life sciences industries, such as aging populations and the demand for substantial enhancements in patient care experiences.

Moreover, a significant number of allocators are keen on gaining access to the healthcare sector due to its reputation for being resistant to economic cycles. As per Coller Capital, 87% of Limited Partners view healthcare and pharmaceuticals as appealing sectors for private equity investment in the upcoming two years. Furthermore, numerous LPs acknowledge the long-term trends and opportunities for innovation in the healthcare and life sciences industries, such as aging populations and the demand for substantial enhancements in patient care experiences.

We recently reviewed Pitchbook’s latest Healthcare Funds Report the trends in the market.

Healthcare specialist fundraising trends

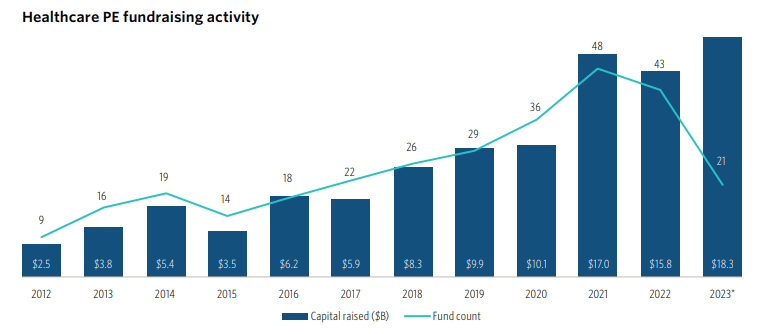

Healthcare-focused private equity fundraising reached a record high in 2023, closing at $18.3 billion by the year's end. This amount continues the rapid fundraising trend initiated by healthcare-focused PE managers in 2021, when fundraising in this sector more than doubled the previous three-year average. However, this increased fundraising activity was primarily seen in larger funds compared to previous years for healthcare-focused PE managers.

This significant level of focus reflects the pattern Pitchbook identified in 2023 for the wider asset category. The proportion of healthcare specialist PE fundraising compared to overall PE fundraising slightly increased from 3.3% to 3.5% in 2023.

However, the situation in healthcare is distinct. In 2023, PE fundraising overall was dominated by closures of flagship funds over $10 billion that initiated fundraising in 2022 or earlier—many of these funds closed below their set targets. In contrast, the landscape for healthcare PE is different.

Several of these companies exceeded fundraising goals in 2023, such as EW Healthcare Partners, Martis Capital, and Varsity Healthcare Partners. Additionally, GP staking activity in 2023 reflects the growth and development of this group: Kudu Investment Management invested in Martis in June, while Revelstoke sold a stake to Bonaccord Capital Partners in September.

In the future, the private equity fundraising landscape will continue to be tough until managers can provide more capital to their limited partners—meaning, until interest rates significantly drop, and larger deals begin to close in the market again. Pitchbook’s prediction is that fundraising for healthcare specialist private equity may slow down slightly in 2024 but will surpass the overall asset class.

Following the sector's recent series of fund closures in 2023, Pitchbook are aware of multiple firms expecting H1 fund closures, with a few larger funds launched towards the end of 2023, such as Webster Equity Partners VI and Patient Square Capital II, targeting $6.0 billion less than a year after Fund I closed. According to trends in 2023, the current landscape appears particularly difficult for emerging managers—classified as those who have closed three or fewer funds—and for managers raising funds under $100 million.

Life sciences VC fundraising activity

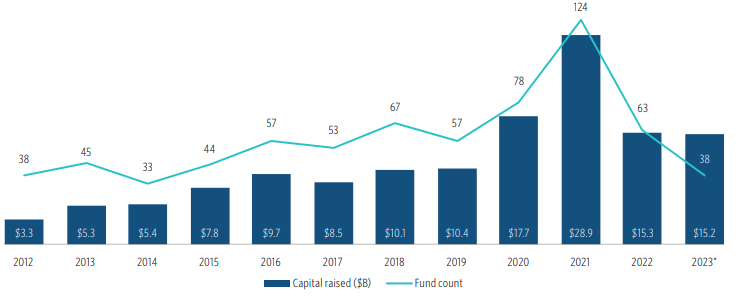

Expert fundraising in healthcare and life sciences was quite robust compared to the past but did not reach the level of activity seen in 2021. Life sciences managers secured $15.2 billion in fund closures in 2023, which was similar to 2020 and 2022, and nearly twice the average from 2017 to 2019. In 2023, fundraising in Venture Capital (VC) for healthcare specialists surpassed the overall asset class.

Specifically, life sciences VC funds made up 17.2% of all closed fundraising dollars during that year, reaching an unprecedented high while the asset class struggled. Collectively, healthcare and life sciences specialist VC funds represented 22.1% of all VC funding closed.

Specifically, life sciences VC funds made up 17.2% of all closed fundraising dollars during that year, reaching an unprecedented high while the asset class struggled. Collectively, healthcare and life sciences specialist VC funds represented 22.1% of all VC funding closed.

Healthcare dry powder

As healthcare expert managers make up only a fraction of the private capital invested in healthcare, Pitchbook used past deal data to approximate the overall available funds—controlled by both specialist and semi-specialist/non-specialist companies—that are expected to be invested in healthcare businesses in private equity and venture capital transactions.

Pitchbook estimate this amount to be approximately $162.4 billion held by managers in North America and Europe for healthcare transactions, $39.7 billion for life sciences venture capital transactions, and $41.9 billion for other healthcare venture capital transactions. For perspective, healthcare expenditures in the United States were $4.5 trillion in 2022. These dry powder figures do not encompass capital ready to be invested by non-traditional investors like corporate venture capital arms and hedge funds, or by institutional investors such as sovereign wealth funds.

It is crucial to note that unused capital is not a dependable predictor of immediate deal patterns, as investors have considerable freedom in their capital deployment strategies. Furthermore, due to the fact that most of this unused capital is managed by non-experts, it is plausible that notable challenges within specific industries—like the current ones in healthcare services and biopharma—could result in decreased capital deployment from investors.

Are you a healthcare fund looking for a heavy weight CFO or finance leader?

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped a number of healthcare and life science organisations find their next CFO.

If you would like to speak to us about hiring a CFO for your portfolio or your owner-managed business, please don’t hesitate to submit a brief.

12/03/24