Q1 European PE breakdown 2025

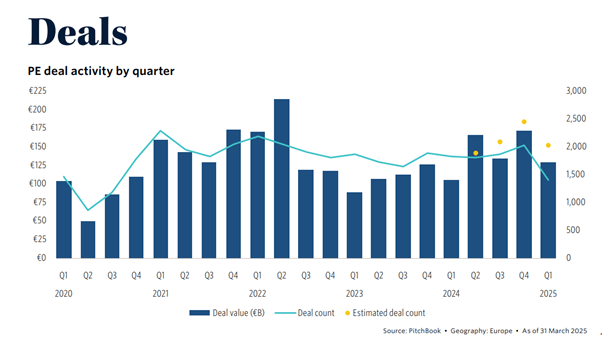

Geopolitical uncertainty slows deal making

Investors are cautious and deals are small

In the first quarter of 2025, companies were careful about making big deals, resulting in only 11 very large deals. The biggest one was Bain Capital's €4 billion purchase of Apleona from PAI Partners. Instead of pursuing large transactions, companies preferred smaller add-on deals to grow their existing businesses, a practice called buy-and-build. In Q1, these smaller add-on deals made up 38.7% of all deal values, an increase from the end of 2024. Medium-sized deals, valued between €25 million and €100 million, showed significant growth, making up 30.7% of the total number of deals. An example is TMF Group's €98 million acquisition of EWM Global. Growth equity deals, which involve taking a smaller ownership stake rather than control, also saw a 15.5% increase, totalling €13 billion in Q1.

Despite the market's volatility, the economic environment had been improving by the end of 2024, which helped in completing deals that started in the previous year. Notably, the app Playtomic raised €65 million to expand to the US. This cautious approach to deal making reflects adjustments in response to market conditions.

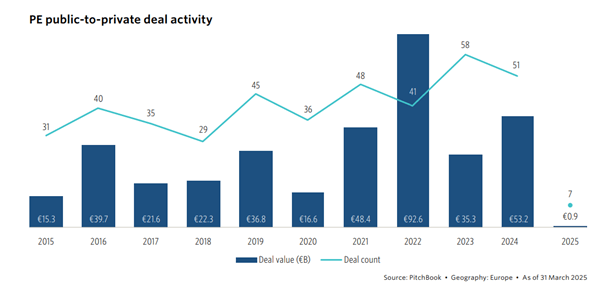

Take-privates cool down

Since the European stock markets have been doing well since November 2024, fewer companies have been taken private. However, there are always some undervalued stocks that may still be involved in these deals. Additionally, due to recent tariffs from the US, public markets have been decreasing, which might lead to more take-private deals in 2025 if stock prices remain low. For example, in Q1, Alliance Pharma was taken private by its largest shareholder, who paid a 44% higher price than the market, but this was still much lower than its highest value in 2022.

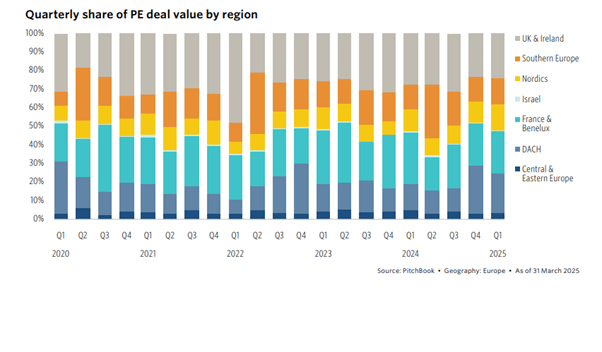

Lower market share for UK & Ireland, higher for the Nordics and DACH regions

The UK and Ireland have seen a significant drop in business deals, reaching the lowest levels since the COVID-19 outbreak in 2020. The value of these deals has also decreased to a low not seen in two years. Rachel Reeves, the Chancellor of the Exchequer, addressed these challenges in March by introducing the Spring Statement, which proposed changes to welfare, public sector efficiency, and housing planning. However, there was no new information about the government's future plans for the carried interest tax, which is set to rise from 28% to 32% in April 2025.

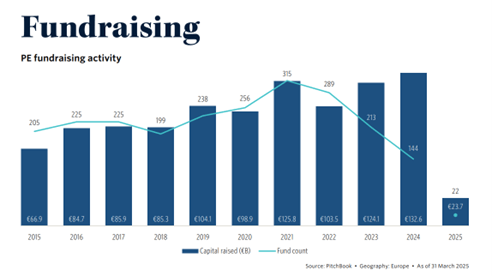

Middle-market fundraising posts a strong Q1

In recent years, European fundraising has predominantly been driven by large funds exceeding €5 billion, termed "megafunds". However, there's a positive shift towards a more balanced market where middle-market funds play a significant role, essential for the industry's growth.

Furthermore, Thoma Bravo, a major US PE firm specialising in software buyouts, made significant strides in targeting Europe. They closed their first fund dedicated specifically to Europe, raising €1.8 billion, and set up a London office, indicating a strong commitment to the European market. This move contrasts with traditionally higher valuations in the US, marking a strategic focus on the comparatively undervalued European market.